Fiona Personal Loans – In today’s fast-paced financial world, personal loans have become a vital tool for people who need to manage their debt, cover emergency expenses, or fund big-ticket purchases like home improvements or vacations.

However, the process of finding the right personal loan with the most favorable terms can be a daunting and time-consuming task. That’s where Fiona comes into play as a viable solution.

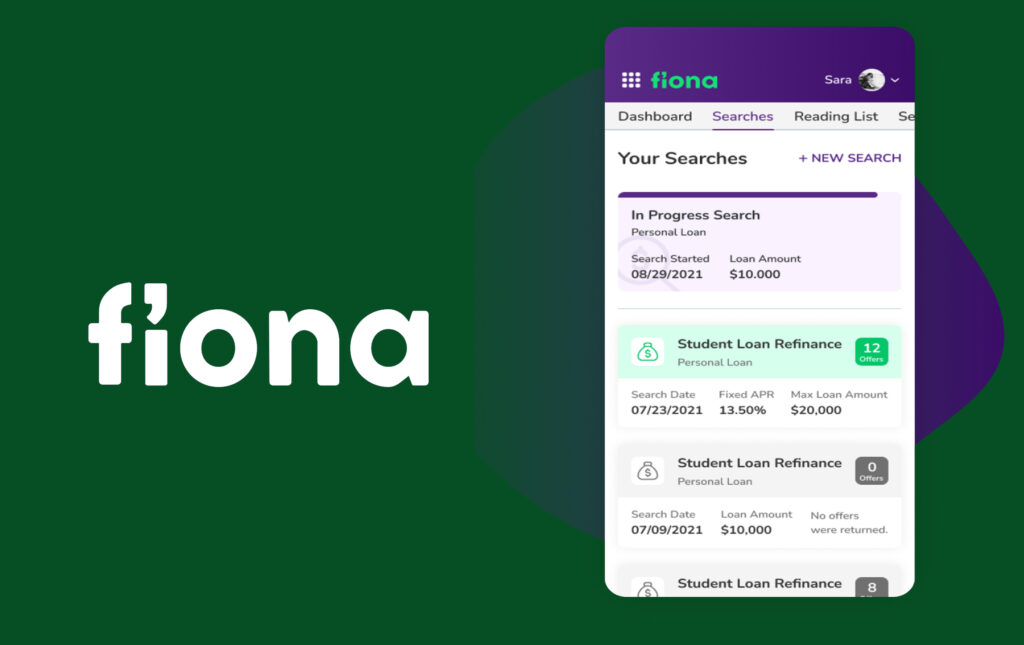

Fiona is a platform that is designed to simplify the personal loans comparison process and connect borrowers with top-tier lenders in minutes.

However, Fiona isn’t a direct lender, but rather an online marketplace that matches borrowers with personalized loan offers from a network of trusted financial institutions.

By filling out one simple application, users can see multiple loan options tailored to their credit profile, loan needs, and financial situation.

What Is Fiona?

Fiona is a loan matching platform created by the fintech company Even Financial. Its primary goal is to help individuals explore various financial solutions quickly by using advanced algorithms to pair them with lenders most likely to approve their application.

Fiona is not a lender, but instead acts as a digital matchmaker.

How Does It Work?

Here’s a step-by-step procedure of how Fiona works:

- Visit the Fiona website or app at “https://fiona.com/”

- Proceed to complete a short form asking for basic financial information, such as the loan amount, credit score range, income, and purpose of the loan.

- Fiona uses your data to scan its network of lenders and returns personalized offers based on your qualifications.

- You proceed to compare the offers, interest rates, terms, and lender reputations—all in one place.

- Once you select an offer, you’re redirected to the lender’s site to complete the application and finalize your loan.

This streamlined process eliminates the need for multiple applications and hard credit checks that can affect your credit score.

Benefits Of Using Fiona For Personal Loans

Before you settle into a personal loan agreement, it’s important to understand the advantages Fiona brings to the table. Here are some of the top benefits that Fiona has to offer clients:

Offers Without Impacting Credit

Fiona allows you to compare prequalified loan offers with just a soft credit pull. This simply means that your credit score remains untouched during the comparison process.

Fast And Easy Application

You only need a few minutes to fill out Fiona’s simple online form. Once you’ve submitted, you’ll see multiple offers in real time, making it a quick solution for those needing cash fast.

Wide Range Of Loan Purposes

Fiona’s lending partners offer personal loans for:

- Debt consolidation

- Emergency funding

- Weddings or major events

- Travel or vacation

- Credit card refinancing

- Medical expenses

- Home renovations

Customizable Loan Terms

Loan amounts range from $1,000 to $100,000. In addition to this, they also have repayment terms between 24 to 84 months, depending on your lender and credit profile.

Trusted Lending Network

Fiona also connects borrowers to reputable financial institutions like SoFi, LendingClub, Best Egg, and Prosper, ensuring that clients are working with legitimate lenders.

Eligibility And Requirements

Fiona doesn’t really set specific eligibility criteria since it’s not an official lender. However, there are stil general expectations based on the lenders in its network.

Your chances of getting the best offers depend on a few factors. Here are some of the basic eligibility requirements you must meet:

- You mustbe at least 18 years old.

- You must be a U.S. citizen or permanent resident.

- While offers are available for all credit types, those with scores 650 and above are more eligible better terms.

- You’ll need to provide employment status and income details.

- Also, you must have a valid checking account for direct deposit.

In addition, jeep in mind that after you choose a lender, the lender may ask for additional documentation to finalize your loan.

The Comparison Between Fiona And Traditional Lending Methods

The traditional approach to applying for a loan often involves you making multiple credit checks, filling out long forms, and making several visits to banks or lenders.

However, Fiona completely redefines and simplifies this process with digital efficiency and convenience. Here’s how Fiona stands out from the traditional methods:

- You haveno need to visit multiple websites because Fiona presents everything in one place.

- You get fast Results by receiving multiple offers within minutes, rather than days.

- There are no hidden fees. Everything is transparent becausethe platform is free to use, and Fiona earns revenue from its lending partners—not from borrowers.

All in all, Fiona lessens the act of guessing out of loan shopping and empowers borrowers with more control over their financial decisions.

Frequently Asked Questions

Is Fiona A Lending Institution?

No, Fiona is not a lender. It is simply a comparison platform that connects you with multiple lending partners based on your profile.

Does Fiona Affect My Credit Score?

No, the initial loan comparison involves only a soft credit pull, which won’t affect your credit score. However, the process of finalizing a loan with a lender may involve a hard inquiry.

How Fast Can I Get A Loan Through Fiona?

Once approved by a lender, the funds can be disbursed within 1 to 3 business days, depending on the lender’s process.