An amortized loan is a type of loan where you make regular payments over time to pay off both the amount borrowed (the principal) and the interest.

Each payment is split between reducing the loan balance and covering the interest cost. As time goes on, a larger portion of your payment goes toward the principal, while the interest portion decreases.

This steady repayment method helps you stay on track to pay off the loan completely by the end of the loan term.

Common examples of amortized loans include home mortgages, car loans, and personal loans, making them a popular choice for many borrowers.

How It Works

An amortized loan works by breaking down your monthly payments into two parts: the interest and the principal (the amount you borrowed).

At the beginning, most of your monthly payment goes toward paying off the interest, but over time, more of your payment goes toward the principal.

This happens because as you pay down the loan, the amount of interest you owe decreases. The interest is calculated based on the loan’s balance, so as the principal decreases, the interest amount reduces as well.

To understand how payments are calculated, the first step is to determine how much interest is due. This is done by multiplying the current loan balance by the interest rate for that period.

The interest due is then subtracted from your total monthly payment to find out how much of the payment goes toward reducing the principal.

After that, the remaining balance is updated, which will be used to calculate interest for the next period.

Types of Amortized Loans

Amortized loans are common in consumer and business lending. Some examples of these loans include:

Mortgage Loans

These are loans secured by property, often with long repayment periods. Residential mortgages usually have 25- to 30-year terms, while commercial mortgages tend to be shorter, ranging from 15 to 25 years, depending on the property.

Auto Loans

These loans are used to finance car purchases and typically have shorter terms, often between 5 and 8 years.

Like mortgages, the monthly payments on auto loans also go toward both the interest and the principal.

Business and Commercial Loans

Businesses use these loans for various purposes, such as buying equipment or funding expansion. These loans are also repaid over time through regular payments that cover both principal and interest.

Amortized vs. Unamortized Loans

While amortized loans include both principal and interest in each payment, unamortized loans only require interest payments during the loan term.

With an unamortized loan, borrowers make smaller monthly payments, but at the end of the loan period, they must pay the full principal amount in a lump sum (known as a balloon payment). Some examples of unamortized loans include:

- Interest-only loans

- Credit cards

- Home equity lines of credit

- Loans with balloon payments (such as some types of mortgages)

- Loans with negative amortization, where payments are not enough to cover all the interest, and the unpaid interest is added to the loan balance.

In comparison to amortized loans, unamortized loans generally have lower monthly payments. However, the need for a large lump-sum payment at the end can make them more difficult to manage.

What Is an Amortization Schedule?

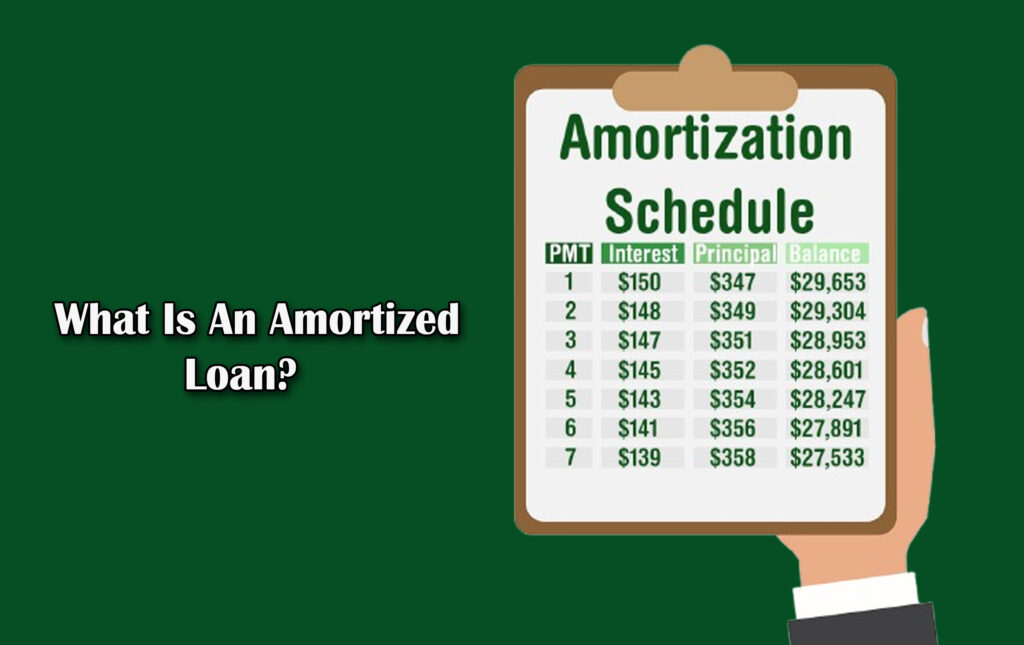

An amortization schedule is a detailed table that shows how each payment on an amortized loan is divided into principal and interest.

This table is useful for understanding how the loan balance decreases over time. For fixed-rate loans, the monthly principal payment stays the same throughout the loan term.

But the portion of the payment that covers the interest gradually decreases as the loan balance goes down.

A usual amortization schedule will include:

- Loan Details: Information like the total loan amount, the loan term, and the interest rate.

- Payments: The total number of payments and how often they’re made (e.g., monthly).

- Total Loan Payments: The sum of all payments that will be made over the life of the loan.

- Loan Principal Payment: The amount of each payment that goes toward reducing the principal balance. This amount increases with each payment.

- Interest: The portion of the payment that goes toward paying interest. This portion decreases as the principal decreases.

- Outstanding Balance: The remaining amount of the loan after each payment is made.

Some amortization tables also show extra payments if borrowers choose to pay more than the required monthly amount. This helps you pay off the loan more quickly.

Conclusion

Amortized loans offer a clear and structured way to pay off both the principal and interest over time.

By breaking down payments into manageable chunks, you can track your progress and understand how much you’re paying toward the loan balance.

Additionally, making extra principal payments can help reduce your loan balance faster and lower the amount of interest you pay over the life of the loan.

To get a clearer picture of how your payments are divided between interest and principal, using an amortization calculator can be a helpful tool.